A New Kind of Wealth: Gen Z Is Rewriting the Rules

For decades, economic success complied with a familiar pattern: gain steadily, conserve boldy, acquire a home, and prepare for retired life. However Gen Z is coming close to money with a fresh viewpoint. Rather than concentrating exclusively on long-term build-up, this generation is focusing on balance, wellness, and deliberate living.

This change has given rise to the idea of soft conserving. It's not regarding abandoning financial objectives yet redefining them. Gen Z intends to live well today while still bearing in mind tomorrow. In a globe that really feels significantly uncertain, they are selecting gratification currently as opposed to delaying joy for decades.

What Soft Saving Really Means

Soft conserving is a mindset that values psychological wellness along with monetary obligation. It reflects a growing belief that cash must support a life that feels meaningful in the present, not simply in the long run. Instead of pouring every added dollar right into savings accounts or retirement funds, lots of young adults are choosing to spend on experience, self-care, and personal advancement.

The increase of this approach was sped up by the worldwide occasions of recent years. The pandemic, financial instability, and altering job dynamics motivated lots of to reassess what truly matters. Faced with changability, Gen Z began to welcome the concept that life ought to be enjoyed along the way, not following getting to a savings goal.

Psychological Awareness in Financial Decision-Making

Gen Z is approaching money with psychological understanding. They want their economic options to align with their worths, psychological wellness, and lifestyle goals. Rather than obsessing over traditional standards of wealth, they are looking for objective in exactly how they earn, spend, and conserve.

This might look like spending on psychological health and wellness resources, funding creative side projects, or prioritizing versatile living setups. These options are not impulsive. Instead, they reflect a conscious initiative to craft a life that sustains joy and stability in a manner that really feels authentic.

Minimalism, Experiences, and the Joy of Enough

Numerous youths are turning away from consumerism for minimalism. For them, success is not regarding owning much more yet about having enough. This ties directly right into soft savings. Rather than measuring wealth by material ownerships, they are focusing on what brings genuine pleasure.

Experiences such as traveling, concerts, and time with good friends are taking precedence over high-end items. The shift mirrors a much deeper wish to live completely instead of gather constantly. They still conserve, yet they do it with intention and equilibrium. Conserving becomes part of the strategy, not the whole focus.

Digital Tools and Financial Empowerment

Modern technology has played a significant role fit how Gen Z communicates with money. From budgeting applications to financial investment platforms, digital tools make it simpler than ever to remain notified and take control of personal finances.

Social media and on the internet communities additionally affect just how economic concerns are established. Seeing others build versatile, passion-driven jobs has motivated lots of to look for comparable way of livings. The access of financial details has actually equipped this generation to create methods that help them rather than complying with a conventional course.

This increased control and awareness are leading lots of to seek out relied on professionals. Consequently, there has actually been a growing passion in services like wealth advisors in Tampa that recognize both the technological side of money and the psychological inspirations behind each decision.

Protection Through Flexibility

For previous generations, economic stability often suggested staying with one work, getting a home, and complying with a taken care of strategy. Today, security is being redefined. Gen Z sees adaptability as a type of protection. They value the ability to adjust, pivot, and discover several income streams.

This redefinition extends to just how they seek financial advice. Numerous are interested in methods that think about career adjustments, gig job, imaginative objectives, and changing family characteristics. Rather than cookie-cutter advice, they desire individualized support that fits a dynamic way of living.

Professionals who offer understanding right into both preparation and flexibility are ending up being increasingly important. Provider like financial planning in Tampa are evolving to include not just standard financial investment advice however likewise strategies for preserving economic wellness throughout shifts.

Realigning Priorities for a Balanced Life

The soft cost savings fad highlights an important shift. Gen Z isn't disregarding the future, but they're picking to live in a manner in which does not give up joy today. They are looking for a middle course where temporary pleasure and long-term security exist together.

They are still purchasing retired life, repaying financial debt, and structure financial savings. However, they are likewise making room for pastimes, travel, downtime, and rest. Their variation of success is more comprehensive. It's not almost net worth yet about living a life that feels abundant in every sense of the word.

This perspective is encouraging a wave of adjustment in the financial solutions market. Advisors who concentrate exclusively on numbers are being changed by those try these out who understand that worths, identity, and emotion play a main function in economic choices. It's why a lot more individuals are turning to asset management in Tampa that takes an all natural, lifestyle-based approach to riches.

The new requirement for monetary wellness blends approach with compassion. It listens to what individuals really want out of life and builds a strategy that sustains that vision.

Comply with the blog for even more understandings that reflect reality, contemporary money behaviors, and exactly how to expand in manner ins which feel both useful and personal. There's even more to check out, and this is only the beginning.

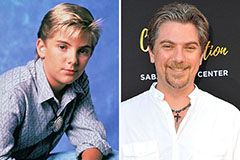

Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Shane West Then & Now!

Shane West Then & Now! Suri Cruise Then & Now!

Suri Cruise Then & Now! Megyn Kelly Then & Now!

Megyn Kelly Then & Now! Nicki Minaj Then & Now!

Nicki Minaj Then & Now!